Last year the Internal Revenue Service passed a temporary policy to help tax professionals and tax payers sign tax forms electronically. The purpose of this policy was to reduce the burden on the tax community allowing taxpayers to use digital signatures on certain forms that cannot be filed electronically.

In recent news, the IRS extended this policy to December 31, 2021. However, the IRS did state that they are considering a possible extension but our fingers are crossed that they are permanently allowed. Now that the IRS extended the eSignature policy on certain tax forms, we’ll give you a quick overview of what’s allowed so you can implement eSignature in your firm.

What is an acceptable electronic signature for a tax form?

An electronic signature is an approval on electronic documents and can replace a handwritten signature. According to the IRS, acceptable electronic signature methods include:

- A typed name typed on a signature block

- A scanned or digitized image of a handwritten signature that’s attached to an electronic record

- A handwritten signature input onto an electronic signature pad

- A handwritten signature, mark or command input on a display screen with a stylus device

- A signature created by a third-party software

Do I have to use a specific eSignature software?

No! The IRS doesn’t specifically list which technology or vendor you must use for eSignatures. In fact, the IRS will accept images of signatures or even common file types such as PDF or a zip file.

What tax forms can I use e-Signatures on?

According to the IRS, digital signatures are allowed on the following paper forms in which taxpayers cannot file using IRS e-file:

- Form 11-C, Occupational Tax and Registration Return for Wagering;

- Form 637, Application for Registration (For Certain Excise Tax Activities);

- Form 706, U.S. Estate (and Generation-Skipping Transfer) Tax Return;

- Form 706-A, U.S. Additional Estate Tax Return;

- Form 706-GS(D), Generation-Skipping Transfer Tax Return for Distributions;

- Form 706-GS(D-1), Notification of Distribution from a Generation-Skipping Trust;

- Form 706-GS(T), Generation-Skipping Transfer Tax Return for Terminations;

- Form 706-QDT, U.S. Estate Tax Return for Qualified Domestic Trusts;

- Form 706 Schedule R-1, Generation Skipping Transfer Tax;

- Form 706-NA, U.S. Estate (and Generation-Skipping Transfer) Tax Return;

- Form 709, U.S. Gift (and Generation-Skipping Transfer) Tax Return;

- Form 730, Monthly Tax Return for Wagers;

- Form 1066, U.S. Income Tax Return for Real Estate Mortgage Investment Conduit;

- Form 1120-C, U.S. Income Tax Return for Cooperative Associations;

- Form 1120-FSC, U.S. Income Tax Return of a Foreign Sales Corporation;

- Form 1120-H, U.S. Income Tax Return for Homeowners Associations;

- Form 1120-IC DISC, Interest Charge Domestic International Sales – Corporation Return;

- Form 1120-L, U.S. Life Insurance Company Income Tax Return;

- Form 1120-ND, Return for Nuclear Decommissioning Funds and Certain Related Persons;

- Form 1120-PC, U.S. Property and Casualty Insurance Company Income Tax Return;

- Form 1120-REIT, U.S. Income Tax Return for Real Estate Investment Trusts;

- Form 1120-RIC, U.S. Income Tax Return for Regulated Investment Companies;

- Form 1120-SF, U.S. Income Tax Return for Settlement Funds (Under Section 468B);

- Form 1127, Application for Extension of Time for Payment of Tax Due to Undue Hardship;

- Form 1128, Application to Adopt, Change or Retain a Tax Year;

- Form 2678, Employer/Payer Appointment of Agent;

- Form 3115, Application for Change in Accounting Method;

- Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts;

- Form 3520-A, Annual Information Return of Foreign Trust With a U.S. Owner;

- Form 4421, Declaration – Executor’s Commissions and Attorney’s Fees;

- Form 4768, Application for Extension of Time to File a Return and/or Pay U.S. Estate (and Generation-Skipping Transfer) Taxes;

- Form 8038, Information Return for Tax-Exempt Private Activity Bond Issues;

- Form 8038-G, Information Return for Tax-Exempt Governmental Bonds;

- Form 8038-GC; Information Return for Small Tax-Exempt Governmental Bond Issues, Leases, and Installment Sales;

- Form 8283, Noncash Charitable Contributions;

- Form 8453 series, Form 8878 series, and Form 8879 series regarding IRS e-file Signature Authorization Forms;

- Form 8802, Application for U.S. Residency Certification;

- Form 8832, Entity Classification Election;

- Form 8971, Information Regarding Beneficiaries Acquiring Property from a Decedent;

- Form 8973, Certified Professional Employer Organization/Customer Reporting Agreement; and

- Elections made per Internal Revenue Code Section 83(b).

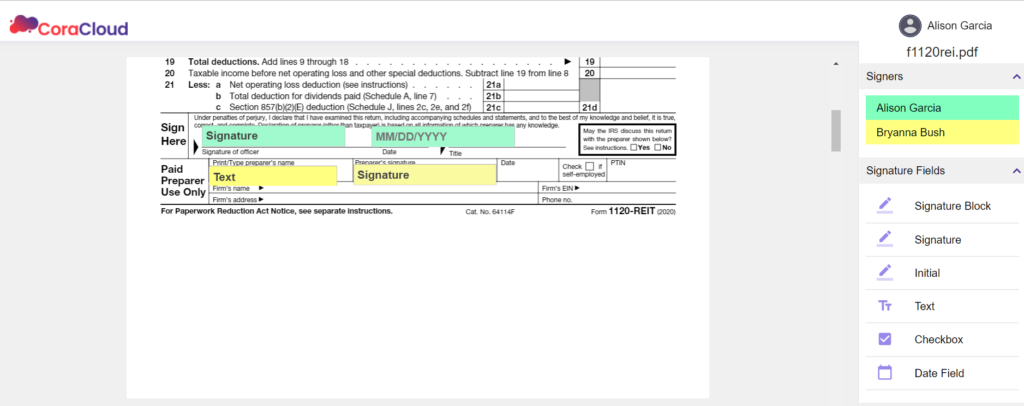

Use CoraCloud’s eSignature Tool to Quickly Sign Your Tax Forms

CoraCloud is your personalized online client portal offering secure bi-directional document sharing, file system management, built in eSignatures and multi-user collaboration. Most portals on the market have an integrated eSign product but that means you pay for every eSign session you send. Not with CoraCloud!

CoraCloud’s eSign is included in your subscription and the best part is that it’s unlimited! That means you can streamline your workflow by filling out these forms in CoraCloud, sending them to your client to sign, and then copies are automatically saved in your CoraCloud account for historical or auditing purposes. Don’t spend any more time hunting down emails, using different software to get a task done, or saving your documents in different places. So what are you waiting for? Learn more about CoraCloud today!